1. Introduction

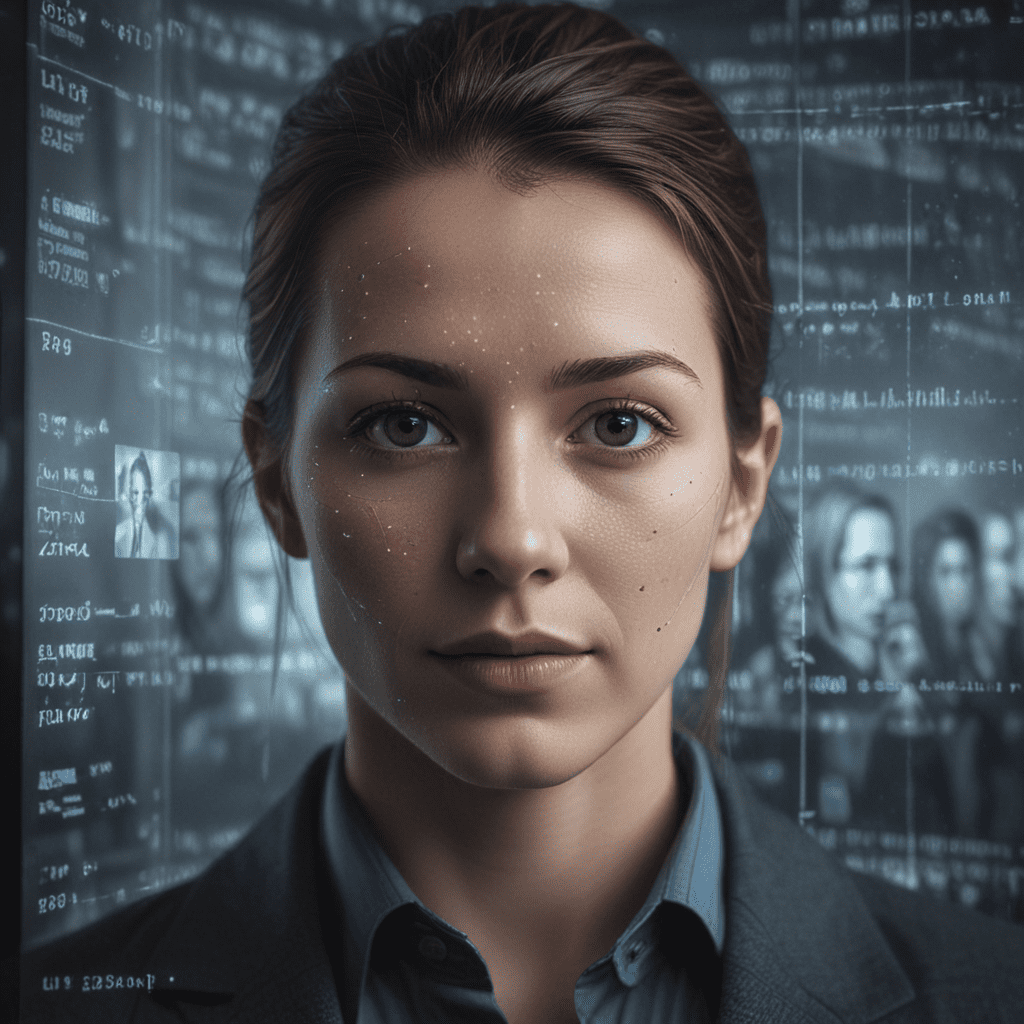

Facial recognition technology is revolutionizing various industries, including financial services. With its potential to enhance security and improve customer experiences, facial recognition is gaining significant traction in this sector. By leveraging advanced algorithms and biometric data, facial recognition systems can identify and authenticate individuals with unparalleled accuracy, providing numerous benefits to both financial institutions and customers alike.

2. Benefits of Facial Recognition in Financial Services

Facial recognition technology offers a myriad of advantages within financial services. It significantly enhances security measures, reducing the risk of fraud and unauthorized transactions. By implementing facial recognition systems, financial institutions can verify customers' identities with greater precision and speed, minimizing the likelihood of identity theft and other malicious activities. Additionally, facial recognition streamlines customer onboarding and account opening processes, providing a seamless and time-efficient experience for individuals seeking financial products and services.

3. Security Implications of Facial Recognition

While facial recognition technology offers robust security benefits, it also raises important security considerations. The collection and storage of biometric data present potential risks, as unauthorized access or misuse could lead to identity theft or privacy breaches. Financial institutions must implement stringent security measures and data protection protocols to safeguard sensitive facial data and prevent potential security vulnerabilities.

4. Privacy Concerns of Facial Recognition

The use of facial recognition raises significant privacy concerns, as it involves the collection and processing of sensitive biometric information. Individuals may have apprehensions about the potential misuse of their facial data, including unauthorized surveillance or tracking. Financial institutions must prioritize transparency and obtain explicit consent from customers before implementing facial recognition systems, ensuring that the technology is used ethically and responsibly.

5. Striking the Balance between Security and Privacy

Balancing security and privacy in facial recognition is crucial for financial institutions. Implementing robust security measures while respecting individuals' privacy rights requires a delicate approach. Financial institutions must establish clear policies and guidelines that define the responsible use of facial recognition technology and adhere to industry best practices and regulatory frameworks.

6. Legal and Regulatory Considerations

Financial institutions deploying facial recognition systems must comply with a complex tapestry of legal and regulatory frameworks. These include data protection laws, privacy regulations, and industry-specific guidelines. Ensuring compliance requires a thorough understanding of the legal landscape and the implementation of robust data governance practices.

7. Ethical Implications of Facial Recognition

The ethical implications of facial recognition technology cannot be overlooked. Financial institutions must consider the potential impact on individuals' privacy, autonomy, and the principles of consent and data minimization. Implementing facial recognition systems in a manner that respects human rights and ethical values is paramount.

8. Best Practices for Implementation

To harness the benefits of facial recognition technology while mitigating risks, financial institutions should adhere to industry best practices. These include obtaining explicit consent from customers, implementing robust security measures, ensuring data privacy, and establishing clear policies for the responsible use of facial recognition systems.

9. Future Prospects of Facial Recognition

Facial recognition technology is poised for continued advancements, with emerging trends such as liveness detection and emotion recognition gaining traction. As technology evolves, financial institutions will need to adapt their strategies to leverage the latest innovations while maintaining a focus on security and privacy.

10. Conclusion

Facial recognition technology has the potential to revolutionize financial services, offering enhanced security, streamlined customer experiences, and a more personalized approach to banking. However, the responsible implementation of this technology requires a delicate balance between security and privacy, careful consideration of legal and ethical implications, and adherence to best practices. By addressing these concerns, financial institutions can harness the transformative power of facial recognition technology while safeguarding the trust and confidence of their customers.

FAQs

Is facial recognition technology secure?

Financial institutions implement robust security measures to protect facial data, ensuring its safe storage and use.Does facial recognition violate privacy?

Financial institutions must obtain explicit consent from customers before implementing facial recognition systems and adhere to strict data protection protocols.How can I opt out of facial recognition?

Customers have the right to opt out of facial recognition systems by contacting their financial institutions and expressing their preferences.

- What are the future trends in facial recognition technology?

Emerging trends include liveness detection, emotion recognition, and the integration of facial recognition with other biometric technologies.