The Impact of Smart Home Tech on Insurance

Introduction

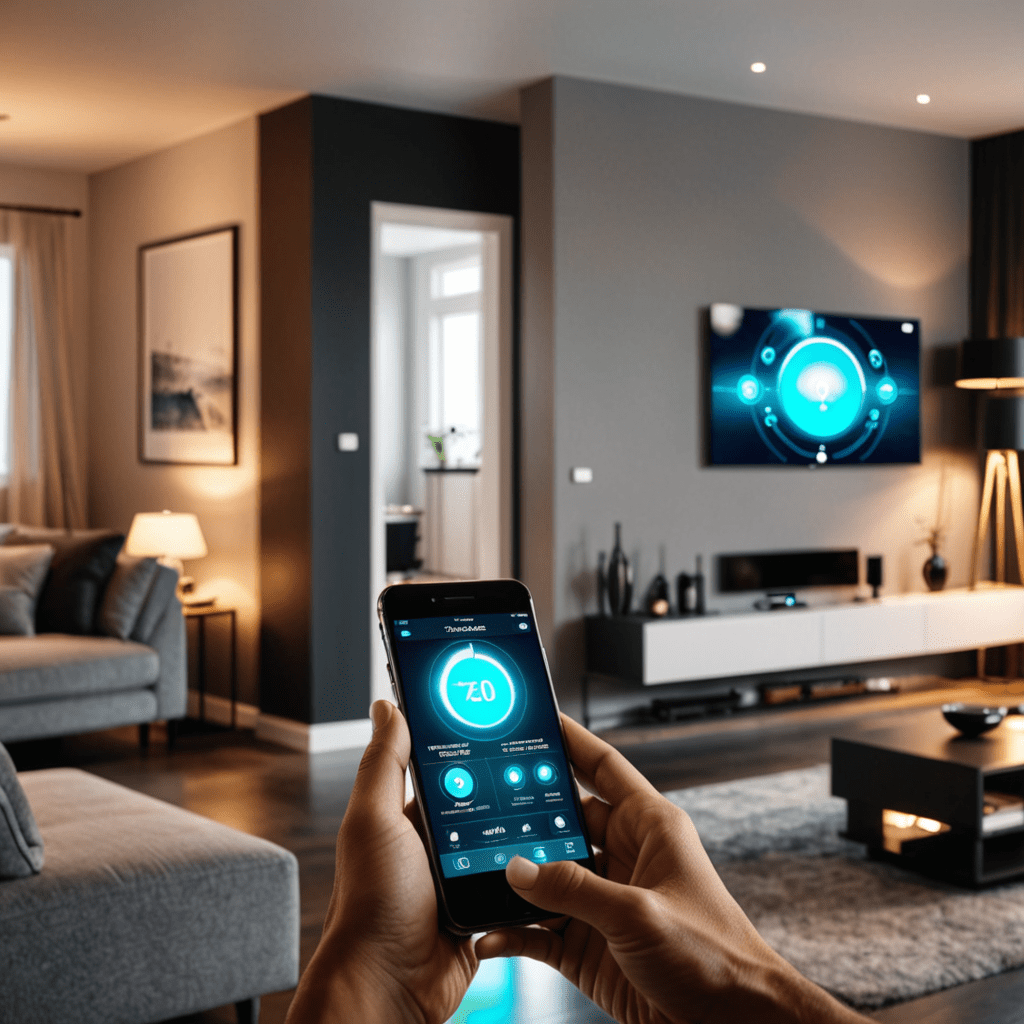

Smart home technology has revolutionized the way we interact with our living spaces, offering convenience, security, and energy efficiency. However, its impact extends beyond just enhancing our daily lives – it also affects the insurance industry in significant ways.

Reduced Risk and Loss Prevention

Smart home devices such as security cameras, smoke detectors, and water leak detectors provide real-time monitoring and alerts, reducing the risk of incidents like break-ins, fires, and water damage. Insurance companies value these preventive measures and may offer policy discounts to homeowners with smart devices installed.

Accurate Data and Personalized Pricing

Smart home sensors collect data on various aspects of the property, allowing insurance companies to assess risks more accurately. With this detailed information, insurers can offer more personalized pricing based on individual behavior and property conditions, leading to fairer premiums for policyholders.

Faster Claim Processing

In the event of a claim, smart home technology can provide valuable data to insurers, helping them assess the situation more efficiently. For example, surveillance footage from smart cameras can offer insights into the cause of a burglary, expediting the claims process and enabling quicker resolution for homeowners.

Preventative Maintenance and Risk Mitigation

Smart home systems can help homeowners take proactive measures to prevent potential issues by monitoring HVAC systems, electrical components, and other critical infrastructure. By addressing maintenance needs promptly, homeowners can reduce the likelihood of claims and insurance companies can mitigate risks associated with property damage.

Enhanced Customer Engagement and Loyalty

Insurance providers that embrace smart home technology demonstrate a commitment to innovation and customer-centric solutions. By incentivizing policyholders to adopt smart devices and offering related services, insurers can enhance customer engagement, build loyalty, and differentiate themselves in a competitive market.

Conclusion

The integration of smart home technology into the insurance sector represents a win-win situation for both homeowners and insurers. From reducing risks and accelerating claims processing to fostering a culture of prevention and customer-centricity, the impact of smart home tech on insurance is profound and promising. As technology continues to evolve, we can expect further advancements that will shape the future of home insurance for the better.

FAQs About the Impact of Smart Home Tech on Insurance

What is the relationship between smart home technology and insurance?

Smart home technology has revolutionized insurance by offering innovative ways to mitigate risks and prevent damage. Insurance companies often offer discounts to homeowners with smart devices installed, as they can reduce the likelihood of claims.

How do smart home devices benefit insurance policies?

Smart home devices like security cameras, smart locks, and water leak detectors provide real-time monitoring and alerts, reducing the risk of break-ins, theft, or water damage. This proactive approach helps insurance companies lower their claims costs, leading to potential savings for homeowners.

Can smart home technology help in the event of a claim?

Absolutely! In case of an incident like a break-in or water leak, smart home devices can provide valuable evidence to support insurance claims. This data can expedite the claims process and facilitate smoother settlements.

Are there any privacy concerns with sharing smart home data with insurance companies?

While sharing data from smart home devices with insurance companies can raise privacy concerns, most insurers prioritize data security and comply with strict privacy regulations. It’s essential to review the terms and conditions of sharing such data to ensure transparency and data protection.